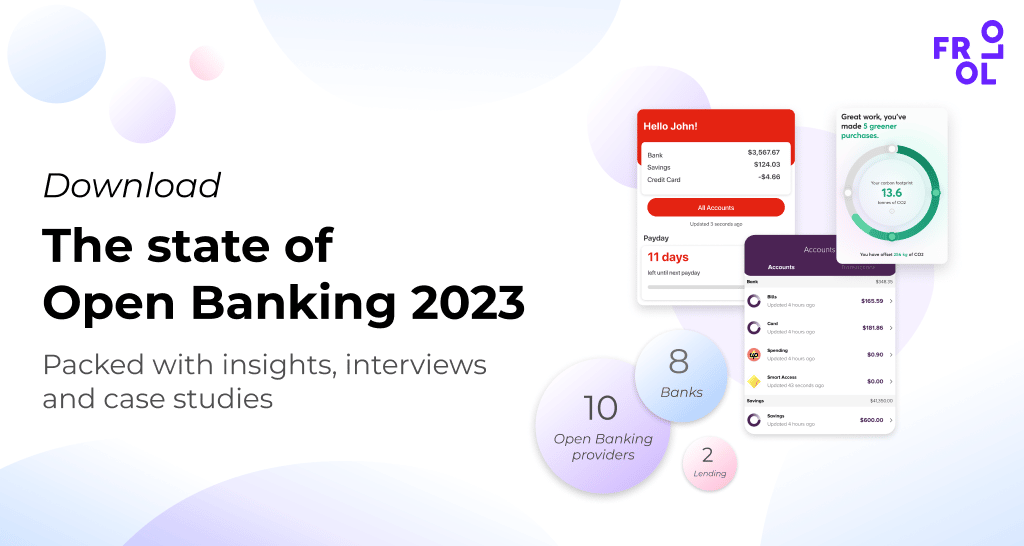

The statistics in this article were last updated in June 2023 to reflect the latest State of Open Banking as of 1 June 2023. The length of CDR Representative arrangements hasn’t been updated as this is no longer publicly available on the CDR registry.

With a network of shareable data now established (despite some room for improvement), the success of Open Banking shifts to answering the question: what do we do with the data? And that answer begins with another question: who gets access to it? This space has changed considerably over the past 12 months, and all signs indicate it’s for the better. Not only has the number of Accredited Data Recipients (ADRs) significantly increased, but new CDR access models are driving participation with opportunities to use Open Banking for innovative new use cases.

Who can use CDR data?

When Open Banking first launched, only Accredited Data Recipients had access to CDR data. Under a new system of Tiered Accreditation, Treasury introduced five new CDR access models to lower barriers, reduce the cost of accreditation and accelerate adoption. These include:

- CDR Representatives

- Trusted Advisers

- Sponsorship

- CDR insights,

- Collecting Outsourced Service Providers (COSP)

At this stage, CDR representatives represent a significant number of participants. A similar model, the Sponsorship model (where an unrestricted ADR sponsors an Affiliate, reducing the compliance burden and cost for the Affiliate to become accredited), has been used by one business, Greener. The number of users of CDR Insights and Trusted Advisers models is hard to establish as they aren’t accredited and not registered with the ACCC. However, Finsure, one of Australia’s leading broker aggregators, has recently started using the Trusted Advisor model with its brokers, indicating the model has support and will likely achieve widespread use.

By consuming Open Banking data, we can provide unique insights into consumer behaviour, assisting brokers to make the right decisions.

Simon Bednar, Finsure

Accredited Data Recipients growth

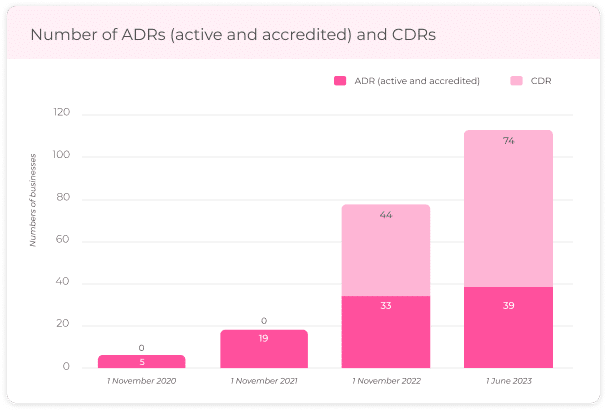

Since 2021, the total number of Accredited Data Recipients has more than doubled, from 19 to 39.

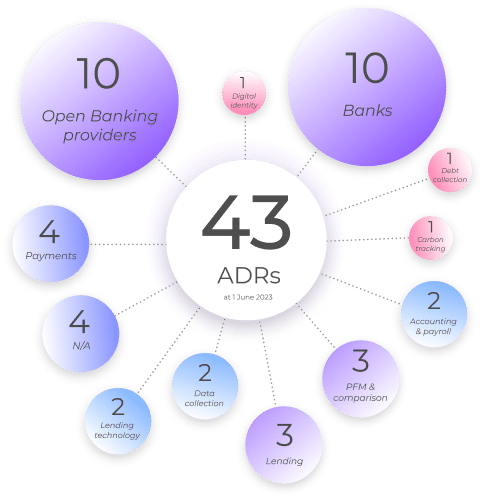

The majority of the ten types of businesses that have become ADRs are Open Banking providers and banks – for obvious reasons. Open Banking providers have to become an ADR to be able to provide their services to many of their clients. And banks, as Data Holders, have a streamlined process to become an ADR, so it’s a logical next step to look for a return on the investment they’ve made to become a Data Holder by using Open Banking data to compete. Banks participating in this space include Beyond Bank and P&N Bank, while new Open Banking providers include Fiskil and Skript. The third biggest category, ‘PFM & Comparison’, includes businesses like Finder and WeMoney, which are live with Open Banking in their app today.

It’s likely that the small number of other types of businesses that have undertaken the arduous process of becoming an ADR, reflects some of the concerns around accreditation complexity previously voiced by industry participants and validates the need for tiered accreditation.

We believe that Open Banking, or Open Data as I prefer to call it, is a revolutionary change in banking and the broader economy – the biggest since digital enablement changed the way customers do their banking.

Chris Malcolm (P&N Group)

CDR Representatives open new doors

What is the CDR Representative model?

The CDR Representative model allows an unaccredited person (the CDR Representative) to provide products and services using CDR data from an ADR (the CDR Principal). The CDR Principal is liable for the actions of the CDR Representative.

Learn more about the different CDR Access models in The definitive guide to CDR access models.

Since the CDR Representative model launched in February 2022, 74 have registered.

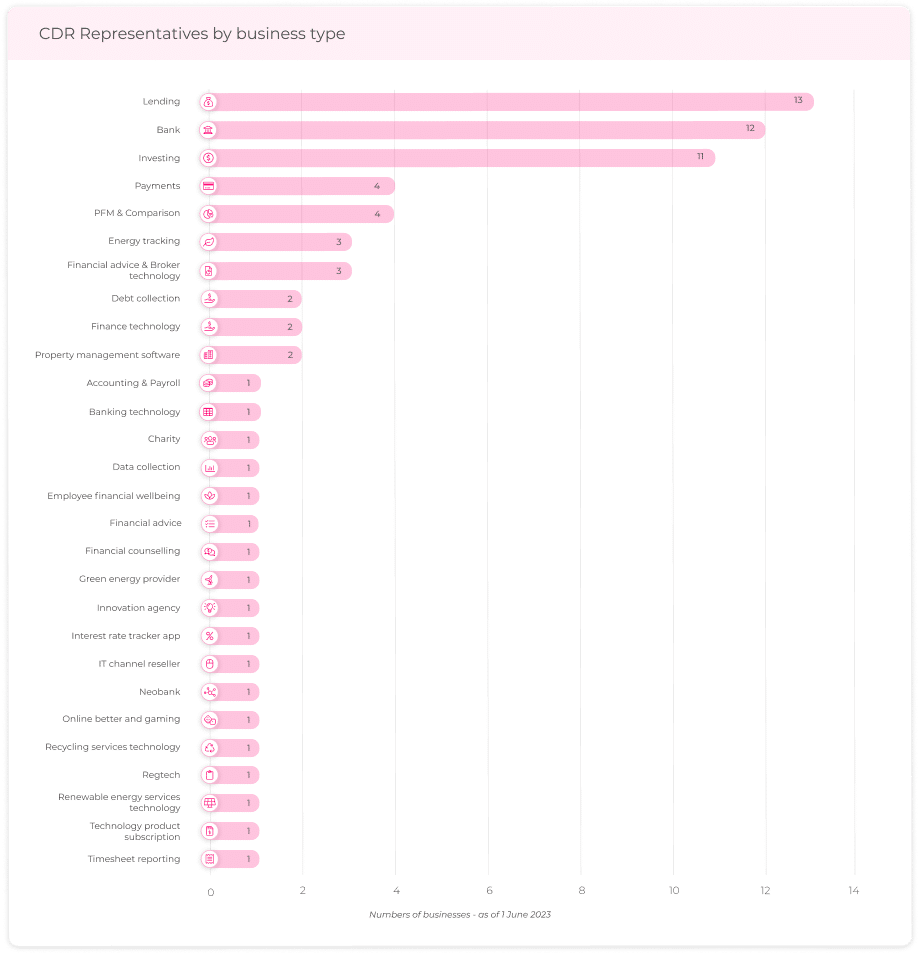

Compared to ADRs, the types of businesses that become CDR Representatives are much more diverse – we’ve identified 28 types of companies that are now CDR Representatives. Of these business types, banks are the second biggest category, representing a quarter of all CDRs. This may seem unusual as banks have a streamlined process to become an ADR. However, most of these banks are using the CDR Representative model to see their own customer data in a production environment – using the model as somewhat of a shortcut to complete their testing.

Of the remaining participants, 11 CDR Representatives are in investing, and four are in payments – two categories often mentioned as those that can get significant value from CDR (for example, using CDR data for checking balances and tracking transactions for roundups).

Combining real-time balance checks through Open Banking with the real-time debiting of funds, makes for a powerful combination.

Christian Westerlind Wigstrom (Monoova)

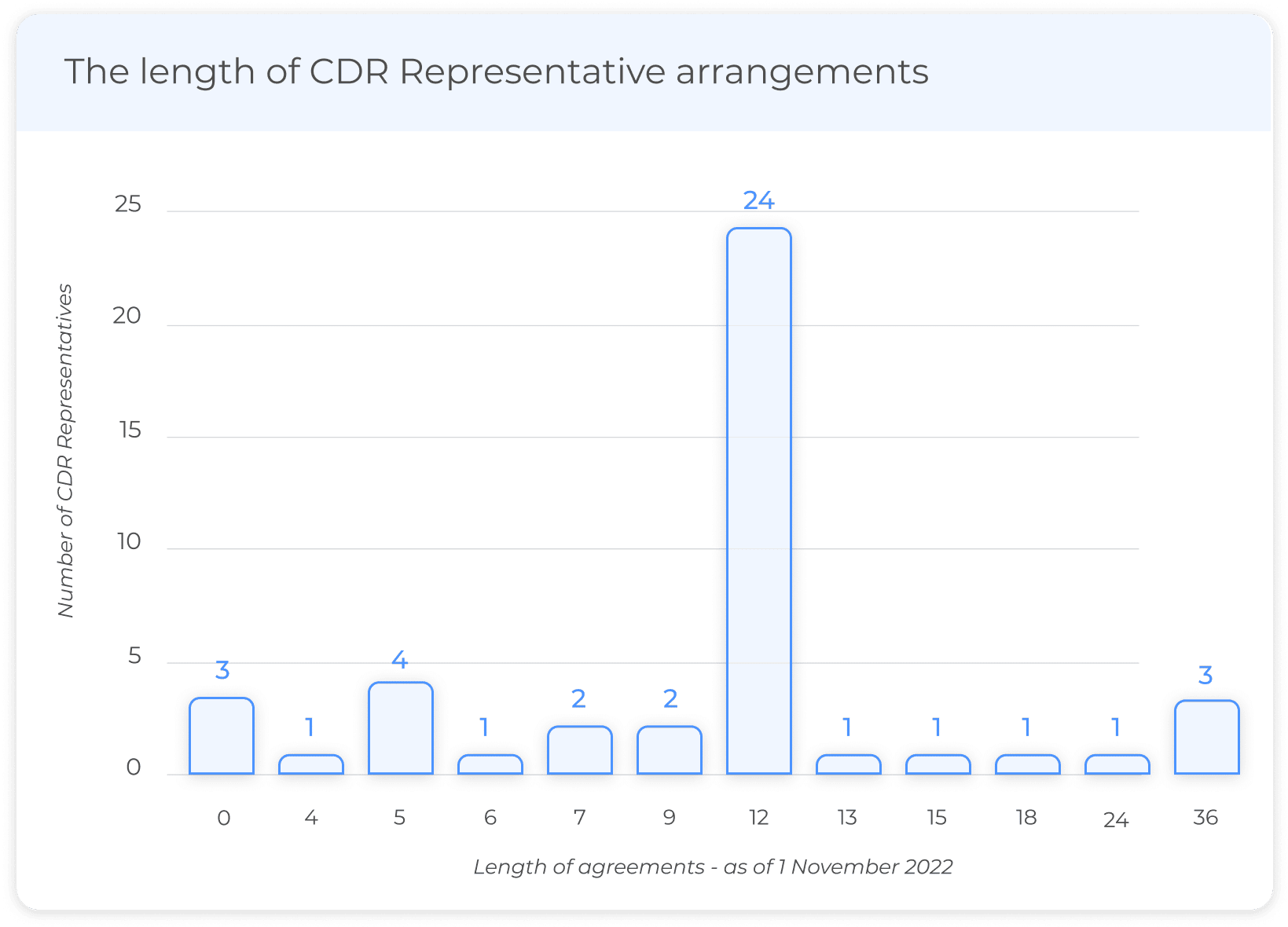

Interestingly, the average length of CDR Representative arrangements is only 12 months. So it’s likely that many businesses are starting to dip their toes in the water and figuring out the value they will get from becoming part of the Open Banking ecosystem before either committing to a longer-term arrangement or becoming an ADR in their own right.

This article is part of ‘The State of Open Banking 2023’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry, interviews with thought leaders and an overview of exciting new use cases.