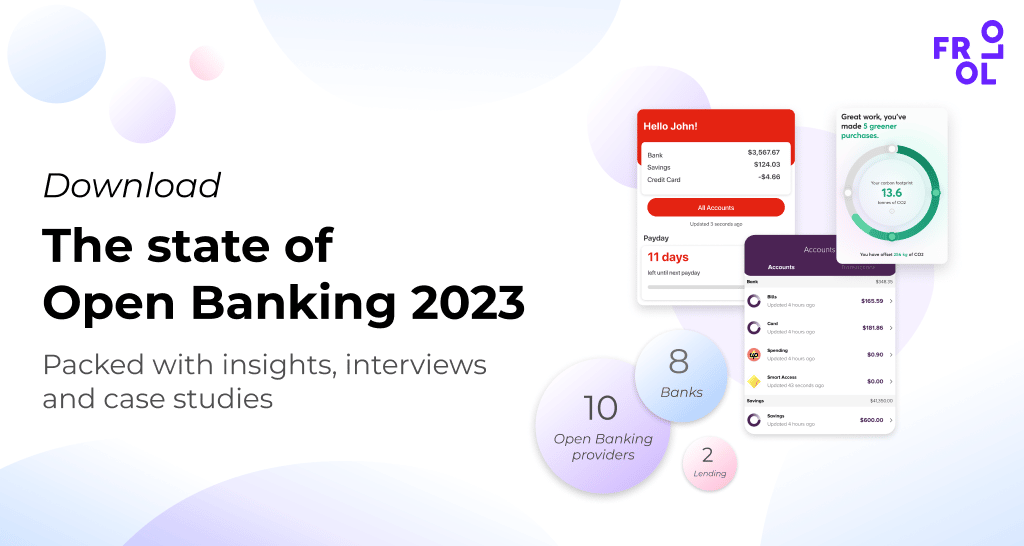

What does the Frollo app do?

The Frollo app offers a simple way for people to turn around their finances and feel better about money. Whether they’re saving for something, paying off a debt or want to get on top of their finances, it only takes four easy steps.

They can:

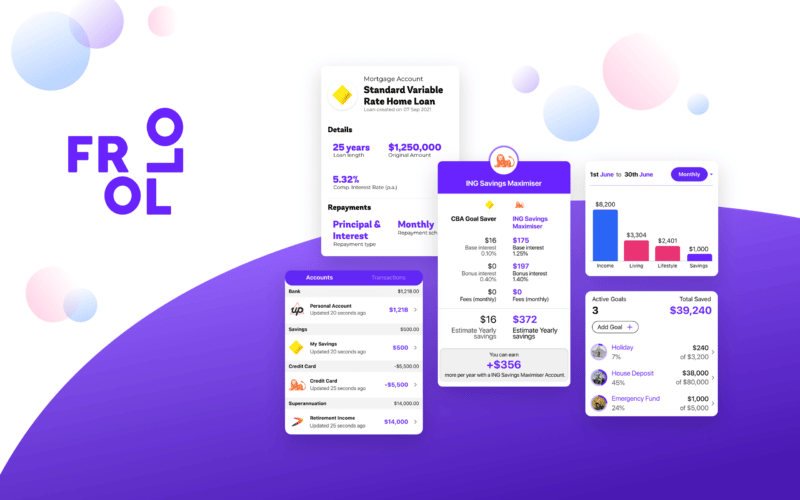

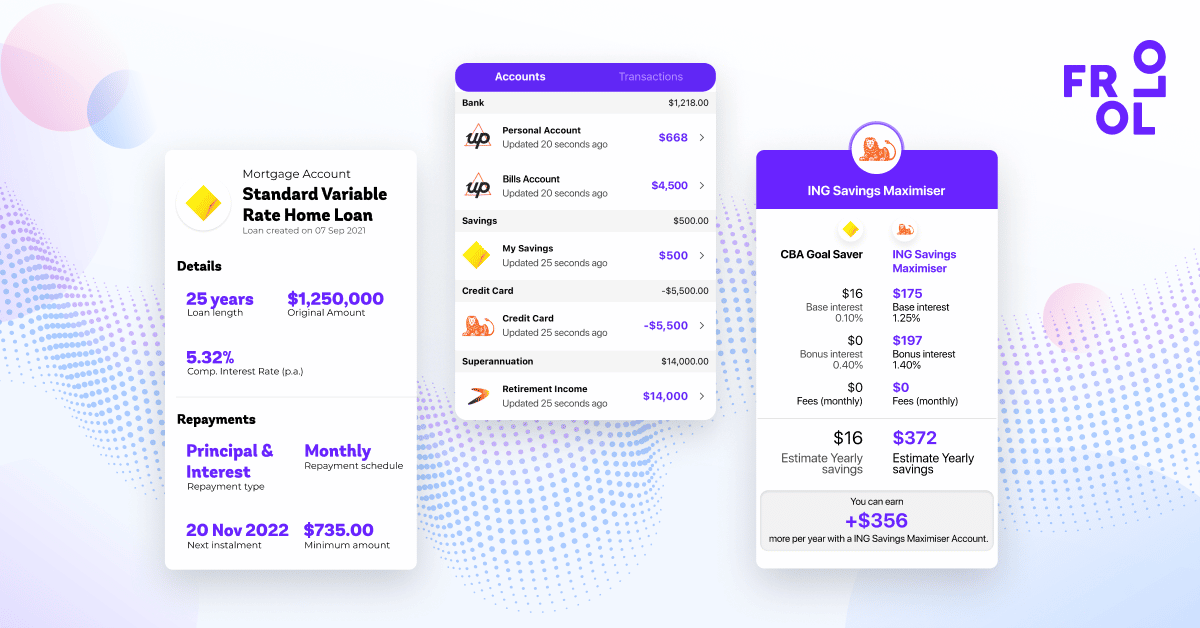

- Link their accounts – Users can connect all of their financial accounts (transactions, savings, credit cards, loans, super, investment and more) with Frollo to see them all in one place

- See where their money is going – Frollo keeps track of regular payments and when they’re due. Easy to read, customisable graphs show users exactly how much they’ve spent on each category and how that’s changed over time

- Get smart money insights – Frollo lets users know when they have insufficient funds to cover upcoming bills, when they can save on subscriptions or when they’ve spent much more on groceries than usual. These and many more insights help users gain a better understanding and more control over their finances

- Stay on track – Users can set and track budgets for specific spending categories or create goals to save for a holiday, house deposit or emergency fund. Frollo automatically tracks their progress and helps them achieve their goals

How does the Frollo app use Open Banking?

The Frollo app uses Open Banking to let people securely link their financial accounts and see them all in one place. It underpins all of the features in the Frollo app that help users improve their financial well-being.

What are the key benefits of Open Banking users of the Frollo app?

Compared to traditional ways of sharing financial data, Open Banking provides a much more secure option, where privacy is completely protected, and users are in control.

Open Banking has also enabled Frollo to improve the app’s user experience significantly by showing account balances and transactions in near real-time.

Another benefit for users is that Frollo can receive and display up-to-date product information for any financial product they’ve linked using Open Banking. This means Frollo can tell them their rates have changed, help them make financial product comparisons, and notify them when they’re about to miss out on bonus interest for their savings account.

This case study is part of ‘The State of Open Banking 2023′, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry and an overview of exciting new use cases – some of which are Frollo clients, some of which aren’t.