In the State of Open Banking 2023, we take a pulse check of the industry and the opportunities it presents for banks, fintechs, brokers and lenders. In this article, we investigate what the future of the Consumer Data Right holds for consumers and businesses.

Australia’s Consumer Data Right (CDR) was always planned to be an economy-wide reform, rolled out sector by sector – with banking being the first. As the Open Banking system that CDR brought us reaches a level of maturity, many eyes are now focused on the next sector to face changes to their data regulation landscape – energy.

But that doesn’t mean there’s not more to come in the banking space. Treasury is developing new rules to empower customers to use their data in new ways. And the CDR will expand to include the broader finance industry, such as non-bank lending, insurance, superannuation and payments data.

The continuing CDR roll-out presents enormous opportunities for innovation, not only within sectors but also across industries where shared data rights can combine to provide real value for the consumer.

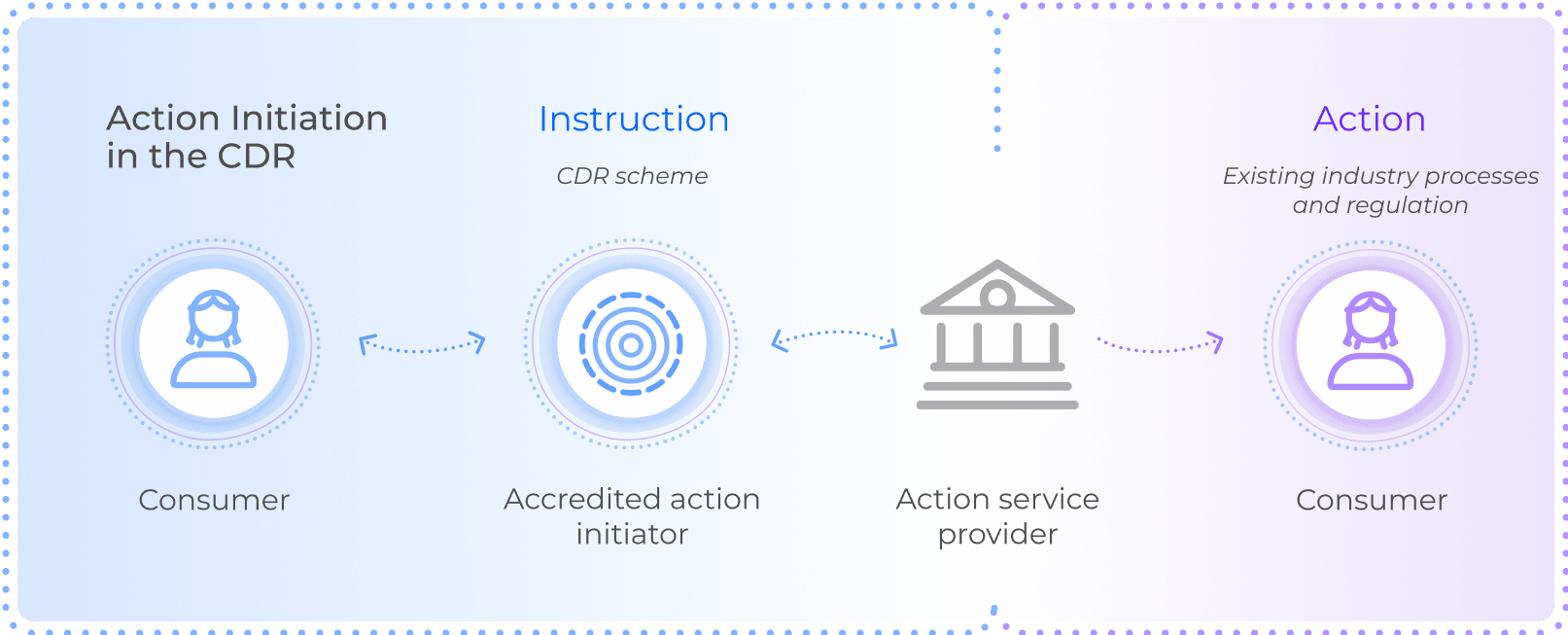

Action Initiation

Action Initiation is the most anticipated Open Banking expansion in Australia – and with good reason. It will create a new channel for consumers to instruct a business to act on their behalf (with their consent). These actions could include:

- making a payment (such as through NPP/Pay to)

- opening and closing an account

- switching providers

- applying for services

- updating personal details (such as address) across providers.

It’s still early days for Action Initiation, as it requires legislation to be passed in parliament and rules to be developed. Draft legislation was published by Treasury on 26 September 2022, so Action Initiation will likely not launch in Australia before 2024. But when it is up and running, it has the power to disrupt how consumers can use their data.

We’ve seen it have a significant impact in the UK. At the end of 2021, 26 million open banking payments had been made, with payments increasing more than 500% in a year.

Merchants will be able to give consumers considerably more choices on what payment method to use in an e-commerce setting, including account a variety of account-to-account options.

Christian Westerlind Wigstrom (Monoova)

What use cases could Action Initiation bring?

Examples of potential use cases:

Multi banking

Manage all your money in one app, regardless of which banks you are with. Make payments, transfer money between accounts, update details or block your card.

Compare and switch

Financial comparison websites can help you find a better savings account and open it on your behalf.

Self-driving finance

Your personal financial management app manages your finances on your behalf, automatically moving money from one account to the other because your balance is low and bills are coming up, or moving money into your savings account to maximise your savings because your expenses are lower this month.

Automated investing

Every purchase you make is automatically rounded up to the nearest dollar and transferred to your investment account.

Open Finance

With more than 100 banks sharing data via Open Banking, coverage of the sector is sound. Yet, a consumer’s financial information isn’t limited to banking, meaning some gaps still need to be filled. Enter Open Finance.

The Government is currently moving towards a phased rollout of the CDR across the broader financial sector, including non-bank lending, merchant acquiring services, and key datasets in the general insurance and superannuation sectors.

Exactly what data is shared will be determined sector by sector, as well as who will be required to comply with mandatory data-sharing obligations (to allow a nuanced approach to accommodate businesses of varying sizes and capabilities). Treasury will progressively assess the other sub-sectors of Open Finance over the coming year, commencing with superannuation. Treasury suggests that: ‘a cross-sectoral data pool that combines consumers’ datasets from non-bank lending, energy, telecommunications and other proposed Open Finance areas may encourage industry to develop innovative products and services.

Open Finance will benefit many use cases, as non-bank lenders, Buy Now Pay Later, and superannuation are products often needed to get a complete financial picture for either lending or financial advice.

Energy in the Consumer Data Right

In terms of new areas after banking, the energy sector is the next cab off the rank, marking the next major milestone for CDR. Consumers will be able to transfer data from their existing energy provider to a prospective provider, third-party provider or product comparison website for an accurate quote. They will be able to share data about their energy usage, account and plan. CDR will help consumers make more informed decisions when looking for better, more tailored deals, helping them save on their energy bills. Combining energy and banking data will allow consumers to track spending, manage their household budget, find ways to reduce unnecessary energy usage and estimate future energy bills.

And the process has begun, although it’s early days.

Product reference data-sharing commenced for the energy sector in October 2022. From November 2022, consumer data-sharing commences for customer data held by the Australian Energy Market Operator (AEMO), AGL Energy Group, Origin Energy Group and Energy Australia Group.

What use cases could energy data bring?

Examples of potential use cases:

Personalised energy comparison

Get a personalised quote based on your historical energy use.

Easy switching to solar

Share your energy data with your bank (for example) and get a personalised recommendation for solar panels based on your energy usage, with the financing to match.

Battery recommendations

Based on your energy use and future need (like the anticipation of buying an electric car), get a recommendation for battery size, brand and best price.

The Consumer Data Right: 2023 and beyond

The hard work won’t end with the energy sector, nor will the opportunity. The CDR is designed to be an economy-wide right. After the energy market, it will be rolled out to telecommunications (as announced by the Government on 24 January 2022). That means it’s crucial for data holders in these industries to prepare for meeting compliance requirements as the system rolls out.

Following telecommunications, no announcements have been made, but there are plans to assess and designate a new sector every year. And the existing regime will continue to evolve as the Government continues to review and reflect on its implementation.

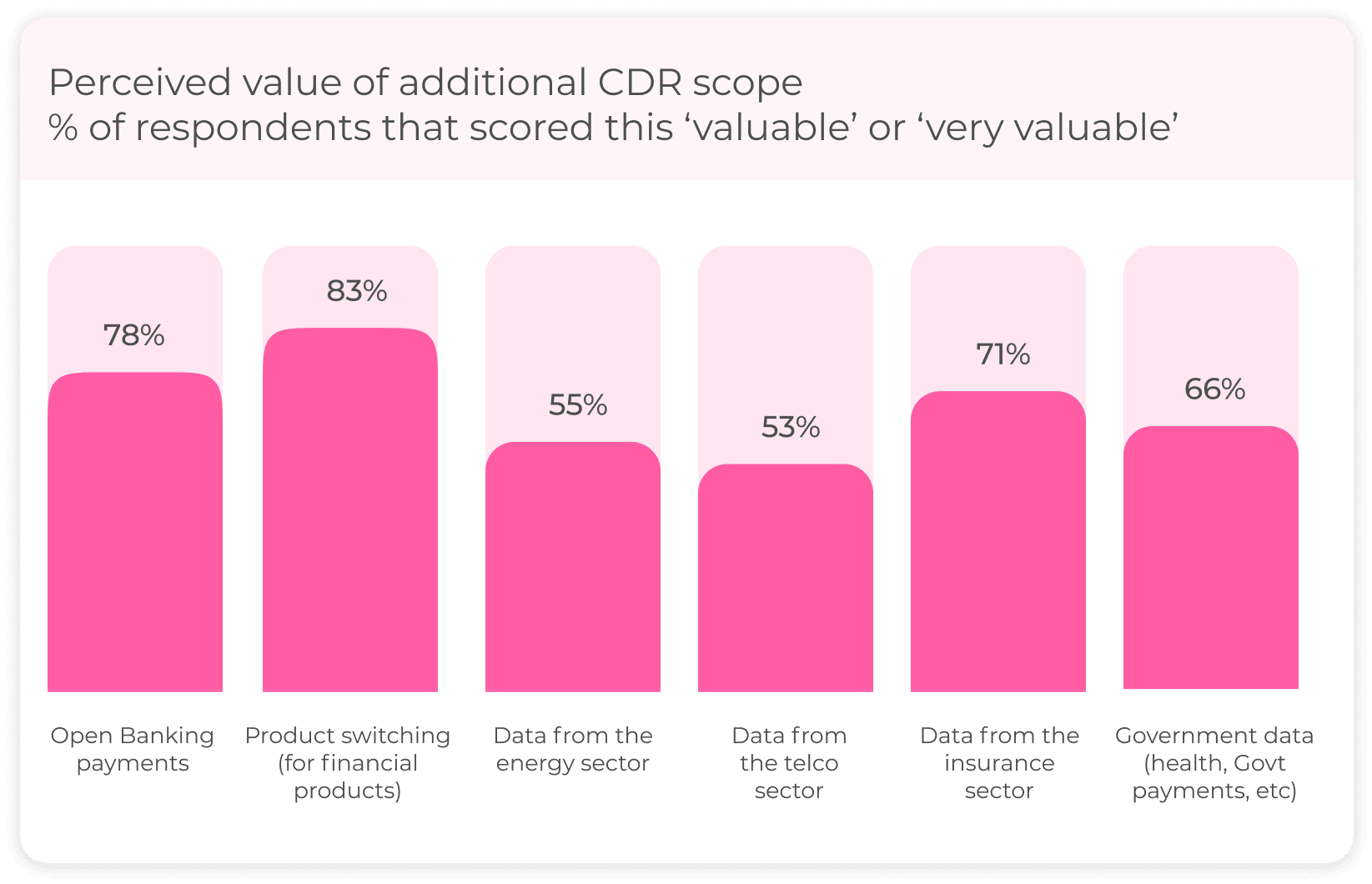

It’s growth that is welcomed. When we asked the industry last year how much they would value additional scope in the CDR, product switching and payments (both Action Initiation) were most popular, and insurance (part of Open Finance) came third. Interestingly, government data (which is not yet designated) came fourth.

While, as a nation, we’re on a solid path to democratising consumer data by transforming it into a usable and valuable resource, there remain many steps ahead. But every step offers better value for the consumer.

This article is part of ‘The State of Open Banking 2023’, an industry report by Open Banking provider Frollo. The report provides a pulse check of the Australian Open Banking industry, interviews with thought leaders and an overview of exciting new use cases.